Ø 2016年会议背景

在过去的10年中,全球仿制药市场发展的增速是专利药的2倍以上。今后几年,将是药品专利到期的高峰,2014-2018年预计将有1295个仿制药到期,影响197亿美元销售额。

——数据来自《2015-2020年*化学原料药行业产销需求与投资预测分析报告》

而在*,药审改革不断加速,仿制药政策变化加剧,对仿制药行业的整体发展产生了重要影响:

关于开展仿制药质量和疗效一致性评价的意见(征求意见稿)出台;

仿制药的申报从两报两批变为一报一批,仿制药的获批速度将大大加快;

仿制药一致性评价*新进展,CFDA发布三大指导原则;

史上*严“药物临床试验数据自查令”如火如荼执行……

根据食药监总局统计,我国有近5000家药企,仿制药企业占90%以上。2018年前后,*的仿制药市场将会在政策变化和竞争加剧的情况下,发生重大调整。

2016年*仿制药峰会将集合CPhI全球资源和前五届峰会的精华,进一步挖掘和探讨仿制药政策法规、市场与竞争、研发与技术方面的重点,为国内外从事仿制药领域的专业人士提供交流与展示的平台,促进国际合作与互动。

Ø 会议架构

|

会议第一天(2016年4月12日) |

第一章:政策探讨 |

|

第二章:市场与竞争 |

|

会议第二天(2016年4月13日) |

第三章:研发与技术 |

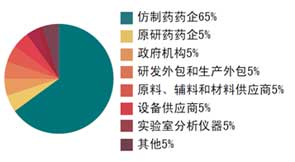

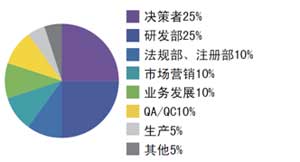

Ø 参会公司及部门

Ø 往届部分参会企业

梯瓦,辉瑞,诺华,勃林格殷格翰,国药,上药,华海药业,扬子江药业,石药集团,上海恒瑞医药,先声药业,海正药业,华北制药,华东医药,齐鲁制药,雅培,迈兰,山德士,阿斯利康,赛诺菲,葛兰素史克,强生,百时美施贵宝,拜耳,罗氏,卫材,武田,葵花药业,海思科,四川科伦,昆明制药,浙江医药,武汉人福,东北制药,海南诺尔康,新疆新姿源,联化科技,上海腾瑞制药,和记黄埔,罗欣药业,南京药石,浙江仙琚,上海腾瑞,上海特化,江苏恩华药业,海正辉瑞,上海欣昌,朗圣药业,中化蓝天,罗氏制药,上海海尼药业,上海现代制药,中信国健,大连美罗药业,广东众生药业,药明康德,正大天晴,丽珠制药,亚宝药业,哈药集团,深圳华力康……

>>请参见完整往届参会名单,含参会人员职位名称

Ø 2016会议议程

|

会议第一天4月12日 |

|

0830-0900 |

注册签到 |

|

第一章:政策探讨 |

|

0900-0910 |

开幕致辞 |

|

0910-0950 |

解读与应对:仿制药质量和疗效一致性评价

一致性评价政策更新的核心内容解读:参比制剂遴选与研究方法选择

一致性评价政策更新对于药品生产企业产品的影响

政策变化中的国内仿制药市场竞争格局变化 |

|

0950-1030 |

新政实施与展望:仿制药企业获得的利好机会

仿制药生物等效性试验由审批改为备案制,缩短仿制药开发周期

仿制药申报从两报两批变为一报一批,获批速度加快

新政的实施展望,及新政环境下仿制药市场的竞争态势分析 |

|

1030-1050 |

茶歇 |

|

1050-1130 |

药品上市许可人制度(MAH)能否在*之行?

药品上市许可人制度的核心内容解读

药品上市许可人制度对于药品研发和创新的积极意义

在*实行药品上市许可人制度的可行性分析 |

|

1130-1200 |

政策变换下的行业整合,CRO企业面临的机会与挑战

政策利好,研发外包服务受捧,CRO企业迎来新的发展机会

临床试验数据自查核查,CRO企业将承担更多责任

在新的政策挑战下,CRO企业如何与药企合作,互利互惠 |

|

1200-1240 |

小组讨论:国内政策的变化以及仿制药产业链内企业的发展出路

美国、欧洲和日本仿制药审评政策的优势借鉴

仿制药临床应用、招标采购、医保报销等配套政策的实施展望

药品生产企业、CRO企业、辅料等其他产业链内企业的发展困惑、瓶颈与未来 |

|

1240-1400 |

午餐 |

|

第二章:市场与竞争 |

|

1400-1440 |

转型中的国内外仿制药市场分析

质量一致性评价对于仿制药市场的影响

国内外仿制药市场发展现状及趋势预估

变化的发展环境与战略调整:首仿药与*仿制药战略 |

|

1440-1520 |

战略合作与投资并购,仿制药企业如何探求新发展

仿制药市场的资本运作现状

通过战略合作与投资并购,实现价值*大化

未来产业的发展趋势预测 |

|

1520-1540 |

茶歇 |

|

1540-1620 |

*仿制药企业进入欧美市场:瓶颈与机会

美国市场的仿制药需求和政策环境机会

*仿制药企业出口欧美市场面临的问题分析

如何突破瓶颈,促进制剂出口升级 |

|

1620-1700 |

*仿制药国际化策略探讨

研发和产品质量上的差距与提升

海外市场的营销与品牌战略

如何制定国际化策略 |

|

会议第二天 4月13日 |

|

0830-0900 |

注册签到 |

|

第三章:研发与技术 |

|

0900-0940 |

仿制药开发过程中的专利战略

知识产权保护对于仿制药企业的重要性意义

仿制药抢仿开发过程中的知识产权纠纷

仿制药企业如何应对知识产权纠纷,促进立项和药品研发 |

|

0940-1020 |

仿制药研发过程中的创新策略与方法

立项的关键点和策略

仿制药研发中的关键技术要点

仿制药产品的质量控制方法 |

|

1020-1040 |

茶歇 |

|

1040-1120 |

药用辅料标准明晰,辅料企业的提升与发展空间探讨

2015版药典新增的药用辅料有标准解读

关键辅料的质量控制对制剂研发的重要性

辅料企业在核心技术、产品质量和服务方面的提升与应对 |

|

1120-1220 |

仿制药杂质控制策略和具体方法

杂质控制在仿制药申请中的法规要求

CMC研究中的杂质问题

仿制药杂质控制的具体策略 |

|

1220-1330 |

午餐 |

|

1330-1410 |

小组讨论:仿制药研发中选择BE实验还是体外溶出试验

国外相关标准的借鉴意义

监管部门的要求和产品申请过程中会遇到的问题

<, SP, style="FONT-FAMILY: '微软雅黑','sans-serif'; mso-ascii-font-family: Calibri; mso-ascii-theme-font: minor-latin; mso-hansi-font-family: Calibri; mso-hansi-theme-font: minor-latin" AN>两种方法的利弊分析 |

|

1410-1510

|

仿制药溶出度曲线的测定与比较

原研药品的多条溶出度曲线测定方法

制定质量标准中的各个参数

溶出度曲线测定过程中的技术要点 |

|

1510-1530 |

茶歇 |

|

1530-1700 |

仿制药生物等效性(BE)试验的指导原则与具体操作

药物制剂人体生物等效性试验指导原则解读

如何准备BE备案资料

BE试验资源现状分析及拓展途径

上市产品再评价申请BE

如何保证BE的试验的真实性和规范性 |

|

1700-1710 |

会议结束语 |

Ø 主办方介绍

博闻*旗下的全资子公司及合资公司于*内地多个主要城市设有10个办事处,包括北京、上海、广州、杭州、广州和深圳。公司提供逾60种产品及服务,包括商贸会展、会议、杂志、网站及培训,产业共涵盖16个市场领域。博闻*是*大陆市场之*大的商营展会主办商,举办多个*首要的展会,当中大部分更属亚洲*大型或全球第二大型的展会。公司举办53个商贸展会、10个会议、出版6本高质专业杂志,以及营运6个垂直网站,为来自国内及全球数以万计的参展商、买家、会议代表、广告商、读者及合作伙伴提供高质素的会面商贸配对、由业界**主持的会议、即时市场动向及新闻、网上贸易网络及采购和市场推广平台。公司在*共有超过550名员工。

CPhI是UBM在医药领域的*展会品牌,母展发源于欧洲。CPhI是**大的制药原料药博览会,每年6月再上海新国际博览中心全馆召开。依托于CPhI的强大号召力,CPhI Conferences致力于通过高标准的专业会议向医药行业*客户传递*新法规政策、市场发展动态、典型案例分析、*新研发技术以及更多的沟通合作机会。CPhI Conferences目前已在欧洲、*、印度、南美四大区域成功举办多场医药行业的*会议。

Ø 酒店地址

上海巴黎春天新*酒店,3楼宴会厅

地址:上海市长宁区定西路1555号

In the past 10 years, the market development growth of generics was twice as much as innovator drugs. In the next few years, there will be a drug patents expire peak. 1295 generic drugs will be off-patent during the year 2014 to 2018, which will affect $19.7 billion in total.

– Data from Analysis report on production and marketing of chemical pharmaceutical industry in China during 2015-2020.

There are lot of policy and regulation updates in China according to CFDA measurement. The new policy will influence the whole generics industry chain in perspective of generics application, quality improvement, clinical data requirement and internationalization.

Based on the data analysis from CFDA that there are around 5,000 pharmaceutical manufacturers in China in total, and 90% of them manufacture generics. There will be big changes and great adjustment around the year of 2018 due to the changeable policy and market environment.

The 6th NEXTGEN CHINA 2016 will gather all resource of CPhI global and essence of past five conferences to explore topics above and showcase evolving generics landscape & solutions.

Ø Conference Structure

|

Day One (April 12, 2016) |

|

|

Chapter Two: Market and Competition |

|

Day Two (April 13, 2016) |

Chapter Three: R&D and Technology |

Ø Who Should Attend

Ø Past Attendees

Teva, Mylan, Sandoz, Pfizer, GSK, Boehringer-Ingelheim, AstraZeneca, Sanofi, Movartis, Merck, JNJ, Abbott, Bristol-Myers Squibb, Bayer, Roche, Dr. Reddy’s, Shanghai Pharma Group, Huhai, Hengrui, Yangtze River, Tasly, China Resources, Xian-Janssen, Qilu, Zhejiang Medicine, Wuhan Humanwell, Northeast Pharm, North China Pharmaceutical, Sinopharm, Kelun Group…

>>Please refer to the whole list of past attendee including Name, Job title Company

Ø 2016 Agenda

|

Conference Day One |

|

0830-0900 |

Registration & Networking |

|

Chapter One: Regulation and Policy Discussion |

|

0900-0910 |

Opening Remarks |

|

0910-0950 |

Clarifying and solutions: generics consistency evaluation on quality and efficacy

Core content clarifying of generics consistency evaluation: selection of reference product and research method

Influence of policy updates on generics manufacturers

Market competition pattern changes due to the policy updates |

|

0950-1030 |

Implementation and forecast: opportunities for generics manufacturers

Changes of bioequivalence test-shorten of development period

Updates of generics application process-speed up approvals

Forecast of the new policy implementation and the different market state |

|

1030-1050 |

Tea Break |

|

1050-1130 |

Drug Marketing Authorization Holder (MAH), feasibility analysis in China

Understanding content and essence of MAH

Positive impacts of MAH on generics R&D and innovation

Feasibility analysis of MAH implementation in China |

|

1130-1200 |

Industrial consolidation under changeable policy environment, opportunities and challenges for CROs

Opportunities for CROs due to policy updates

More responsibilities for CROs based on clinical data inspection

How to cooperate with generics manufacturers for mutual benefits |

|

1200-1240 |

Panel Discussion: Policy and regulationupdates and the development of the whole generics industrial chain

Advantages and experience sharing from policy in US, EU and Japan

Supporting policies in clinical application, purchasing and bidding and medical-care system

Development bottleneck and trend for manufacturers, CROs, excipients suppliers and other industrial chain companies |

|

1240-1400 |

Lunch |

|

|

|

1400-1440 |

Analysis of the changing generics market in Chinese and overseas

Influence of generics quality consistency evaluation on market trend

Current situation and tendencies of Chinese generics market

Strategy adjustment like first generic drug and high-end generics |

|

1440-1520 |

Strategic cooperation and M&A-how to seek for new chances for generics manufacturers

Current situation of capital operation in generics market

To realize value maximization through strategic cooperation, investment and M&A

Trend prediction of the whole generics industry |

|

1520-1540 |

Tea Break |

|

1540-1620 |

Export to US and EU market, bottleneck and opportunists for Chinese generics manufacturers

The requirement and policy environment in US

Problems for the export to US and EU market, and solutions exploration

How to break through bottlenecks to promote formulation export |

|

1620-1700 |

International strategy discussion for Chinese generics

The gap and improvement of product R&D and quality

Marketing and brand strategy in overseas market

How to formulate the international strategy |

|

Conference Day Two |

|

0830-0900 |

Registration & Networking |

|

|

|

0900-0940 |

Intellectual property strategy in generics development process

Importance of IP protection for generics manufacturers

IP rights dispute in generics development process

How to reply the IP dispute to speed up project setting up and R&D |

|

0940-1020 |

Innovative strategy and methods in generics R&D

Key points and strategy of project setting up

Key technology in generics R&D

Quality control approaches of generics |

|

1020-1040 |

Tea Break |

|

1040-1120 |

Standard of excipients and development for excipients suppliers

Exploring standard of excipients in 2015 pharmacopeia

Quality control of key excipients and the importance for formulation R&D

How to make improvement in perspective of key technology, product quality and service for excipient suppliers |

|

1120-1220 |

Strategy of generics impurity control and the specific methods

Regulation requirement of impurity control in generics application

Impurity control in CMC research

Specific methods of generics impurity control |

|

1220-1330 |

Lunch |

|

1330-1410 |

Panel Discussion: Bioequivalence test or dissolution test in generics R&D?

Reference of related standard and research

Requirements of regulatory bodies and problems in product application process

Analysis of advantages and disadvantages of BE test and dissolution test |

|

1410-1510

|

Testing and comparison of dissolution rate

Testing methods of multitier dissolution rate in innovative drug

Determine the parameter of quality standard

Key technologies in dissolution testing |

|

1510-1530 |

Tea Break |

|

1530-1700 |

Governing principles of BE testing and the specific practice

Exploring the principles of formulation BE testing

How to prepare the BE data and material

Resource analysis of BE testing and expansion methods

How to apply for BE for re-evaluation for listed product

How to confirm the authenticity and normativity of BE testing |

|

17001710 |

Close Remarks |

Ø About Organizer

We serve 16 market sectors with wholly-owned subsidiary companies and JV companies in 10 offices in the major cities in mainland China, including Beijing, Shanghai, Guangzhou, Hangzhou, Guzhen and Shenzhen. We provide over 60 products and services in various categories: trade fairs, conferences, publications, websites and training. As China’s largest commercial exhibition organiser, we stage the leading events of their kind in China, most being the largest in Asia or second in the world. Our 53 exhibitions, 10 conferences, six publications and six vertical portals serve tens of thousands of exhibitors, visitors, conference delegates, advertisers, subscribers and corporations in the country and from all over the world with high value face-to-face business-matching events, quality conference programs presented by top-notch industry leaders, instant news on market and industry trends and round-the-clock online trading networks and sourcing platforms.

CPhI Conferences deliver the latest pharma market insight, in-depth case studies and exceptional networking opportunities through a programme of high-level conferences. The worldwide series of events, spanning four continents, provides the optimum forum for you to learn, make new business connections and identify the latest growth opportunities.

Ø Hotel Info

Ballroom in 3F, New World Shanghai Hotel

Address: No. 1555 Dingxi Road, Changning District, Shanghai, China

苏公网安备32041102001157号

苏公网安备32041102001157号